Paid Internships for Students

Interested in an Internship?

With the Xperience project at NHCC, you can gain professional experience and earn college credit through a paid internship.

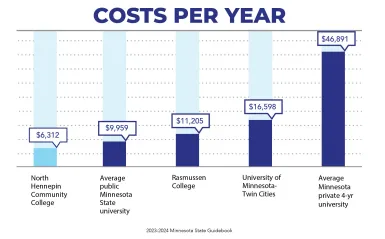

Paying For College

NHCC's tuition is among the most affordable in Minnesota.

Financial Aid

- Scholarships are money you don't have to repay

- Grants are money you don't have to repay

Program Roadmaps

Program roadmaps provide students with a guide to understand the recommended course sequence to complete their degree.

Get Started

If you're ready to get started, apply to NHCC. If you'd like to learn more, you can visit campus or request information.